What a wonderful roast dinner this was tonight. Shame couldn’t put more on the plate.

General life story

What a wonderful roast dinner this was tonight. Shame couldn’t put more on the plate.

This morning I received an email about life expectancy, here are the main points from it.

“Boys born in the UK in 2023 can expect to live on average to age 86.7 years and girls to age 90.0 years based on projections of cohort life expectancy, which take into account future improvements in mortality.

Cohort life expectancy at birth in the UK is projected to reach 89.3 years for boys and 92.2 years for girls born in 2047, an increase of 2.6 years and 2.2 years, respectively from 2023 levels.

People aged 65 years in the UK in 2023 can expect to live on average a further 19.8 years for males and 22.5 years for females based on cohort life expectancy, projected to rise to 21.8 years for males and 24.4 years for females by 2047.

A projected 17.3% of boys and 24.7% of girls born in 2047 in the UK will live to at least 100 years old, an increase from 11.5% of boys and 17.9% of girls born in 2023.

Our latest projections of cohort life expectancy at birth are 1.0 year lower for males and 0.5 years lower for females born in 2047 than the 2020-based interim projections.”

Good to see that it’s getting longer, but then what’s happening in the world, who knows if it’s good?

What do you think?

Tonight was the final night of UK Traitors series 3, we had never watched it before, but had seen several clips on GoggleBox and thought we would give it a try.

We both really enjoyed it and Claudia Winkleman is a brilliant presenter of the show. It was a shame at the end that the people couldn’t trust each other, as there were 4 faithful’s left, but 2 were banished in the final task.

This morning we had the new gas cooker delivered.

Everything went smoothly with removing the old cooker and connecting up the new one.

Just shows that some prices haven’t changed that much, the cooker was virtually the same price as the one that we purchased in 2013, the big difference was the cost for the old to be taken away and for it to be connected up.

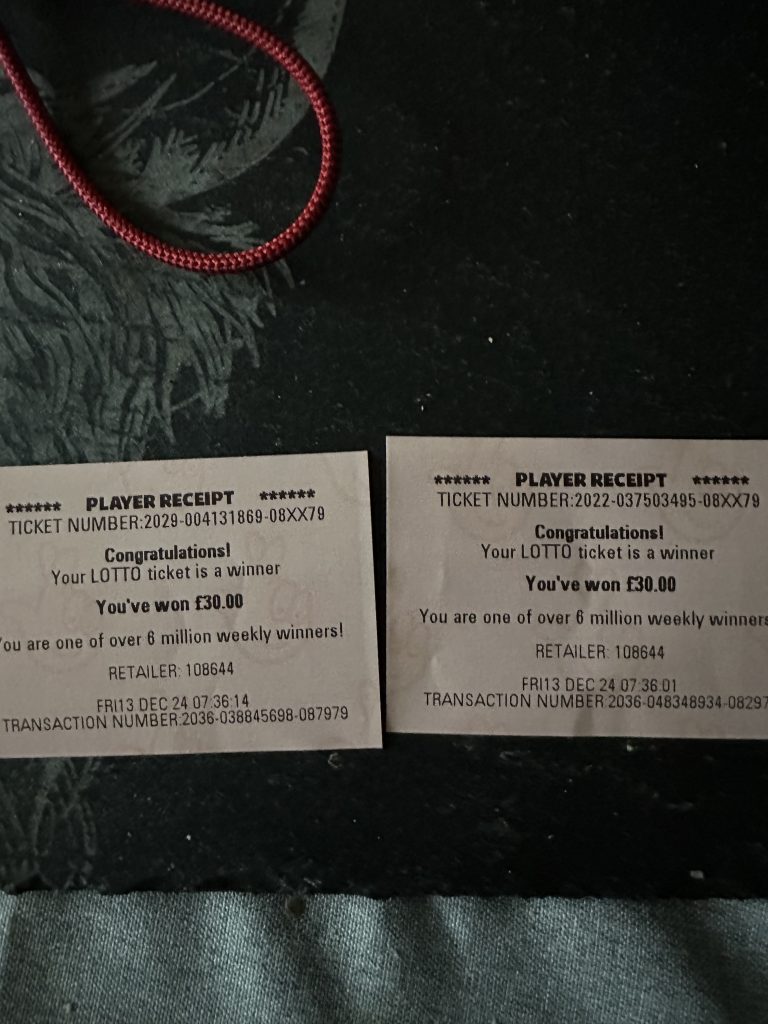

I think this year is our best year for money wins on the National Lottery, with two three balls wins for 2x£30 wins.

Earlier in the week, the big gas oven decided to stop igniting up. Everything else on the oven was working and after searching around on the Internet, it appears that the thermostat had stopped working.

So today we went to Currys to hopefully purchase a new gas cooker.

We had the help of a great sales assistant and ended up buying a Montpelle gas cooker.

Whilst we were looking around, we noticed one gas cooker at a price of £9,999, we looked at it and the read the information and couldn’t understand why and asked the sales assistant and he went what and we showed him. He said oh that shouldn’t be out as it’s a return and should be out the back and not on the shop floor.

Luckily we will not be at home for Christmas, because due to the gas fitting of the oven, it wasn’t going to be delivered until January 2nd.

Today I sponsored Kojo for doing an overnight sleepout to help the homeless.

It’s crazy in this day that people are sleeping rough, though that about sums up this crazy world, with wars going on around the world, people sleeping rough, people being knifed and killed for what?

We should be living together with peace and love. Just shows we have not learned anything from our history.

So well done Kojo and his daughters for doing this.

What a star and friend he is.

The last couple of days this blog had been updated behind the scenes but had a massive change on the website.

I tried some stuff which helped a little bit, but the website still looked awful.

I contacted Mark and within 48 hours the website is looking as if nothing had changed apart from the changes that I wanted.

Thank you Mark for rescuing me. What a FRIEND!!

Claire today picked up her new IPhone 16 from EE.

So after all these years, I upgraded my IPhone 8 to her 14 that she handed down.

The moving all the apps and details from one phone to another was so easy and was done in less than hour.

Crazy, not long back from our fantastic holiday and were ordering food for Christmas.

Already some of the options were not available, were only just into October.

The good thing, was the sizes and prices were virtually the same as last year, so M&S were helping people with doing that. Well done M&S